从左至右依次为:莫静茹、王黎阳、陶钧

本文为清华-康奈尔双学位金融MBA2019级“数据分析与创业决策”课程报告,作者是第十六小组:莫静茹、王黎阳、陶钧(组长)、龙华江。授课教师:余剑峰。余教授现为清华大学五道口金融学院建树金融学讲席教授、清华大学金融科技研究院副院长、清华大学国家金融研究院资产管理研究中心主任。2014-2015年期间为清华大学五道口金融学院的访问教授。2011年起是美国联邦储蓄银行(达拉斯)的研究员。他主要从事行为金融和宏观金融的理论和实证研究,研究成果已经发表在多份学术刊物,例如,美国经济评论、金融期刊、金融经济期刊、货币经济期刊、管理科学和动态经济评论等。余教授获得中国科技大学概率统计学学士,耶鲁大学统计学硕士和宾夕法尼亚大学沃顿商学院的金融学博士。他的研究成果曾获得多项奖项,其中包括 Smith-Breeden一等奖。

The Impact of Female Directors on Stock Price

Introduction

Purpose of this paper is to examine whether the presence of female directors will have an impact on company performance, focusing specifically on share price movements for public companies (US and China), and to capitalize on our findings – recommend suitable arbitrage strategies. As there are enough literature advocating the need for gender diversity in the board room, our intention is to decipher to what extent is the presence of female directors impactful on shareholder value.

First, let’s set up some parameters and context useful for our analysis. The direct impact of female presence in the board room is rather difficult to measure and inconclusive in the available literature since positive correlation (Campbell and Minguez-Vera, 2008), negative correlation (Ahren and Dittmer, 2012), and no correlation (Adams and Ferriera, 2009) all coexist between the link of female directors on the board and firm performance. Fortunately, most literature concurs on - a greater fraction of female directors appears to increase firm value – but under the condition of when the CEO is ‘overconfident’.

Investors are sensitive to a company’s propensity for risk. At the core of a company’s risk appetite lies with its CEO, and if the leader is perceived as overconfident, this signals major warnings for investors. Overconfident CEOs can be egocentric and prone to rash decisions leading to inefficient investments, as well as overestimate the future returns of their companies and therefore overinvest in below average projects (Malmendier and Tate, 2005). Having female directors or in senior management positions (C level) may mitigate this risk. From a governance perspective, female directors can be more effective in monitoring and managing overconfident CEOs from impulsive decisions (Adams and Ferreira, 2004). Through efficient monitoring some female directors are able to restrain management from, among other things, investing in potentially high risk/questionable return investments. From a corporate investments perspective, women tend to be comparatively more risk averse (Adams and Ferreira, 2004) and research documented that firm risk-taking, measured by the standard deviation of stock returns, declines with an increase in female directors on the board which, in turn, stabilizes stock returns, this is particularly applicable in a bear market, where cash reserves are low and positive NPV projects are limited.

Second, consistent with Critical Mass Theory, female presence on boards does not make substantial effect unless a critical mass of three or more is accomplished (Konrad et al., 2008), since “one is a token, two is a presence, and three is a voice.” (Liu, Wei and Xie, 2014). This is logical as a critical mass of female directors can ensure presence are felt, and vote against the ill-advised or rash decisions of overconfident CEOs, and thus inhibiting their power and mitigating the negative con-sequences of such misuse of power. This reinforces the question raised earlier, to what is the exact “right level” of critical mass need to maximize boardroom value?

Efficient Market Hypothesis Nexus

The rationale of female presence on the board impacting corporate performance should also be reflected in the stock, as per the efficient market hypothesis (EMH), where in an efficient market it is impossible to “beat the market” because stock market efficiency causes existing share prices to always incorporate and reflect all relevant available information (Ball, 1994). As such, in efficient markets, the investors’ response to the announcement of a female appointment to the board should immediately be reflected in the company’s share price -when female representation is perceived to be value adding, the market will correspondingly reflect a positive reaction through an increase in the price of the stock.

Conversely, a neutral or negative market reaction to the announcement of a female elected to the board of directors occurs when that female is perceived to be a “trophy director,” so to speak. Women in this position may not be comfortable standing out, at least initially, and may not want to rock the boat, causing their talent to stay hidden and muted. When this is the case, the female director’s talent does not translate into any differences for the company; it is essentially the same as before the appointment, except that the gender diversity box has been checked. If investors perceive this to be the case, they will not have much of a reaction to the female being elected, causing the market valuation of the company to essentially stay the same, or drop. Consequently, a general expectation that an initial dip in stock price is anticipated once an announcement of female director appointment is made, particularly during bull market, as women are associated with being more cautious and risk averse (Kramer et al., 2006). It was found that initially the market reaction to the appointment of the first female to a board of directors is often negative. However, over time, specifically one and five years after the announcement, the market will recalibrate as per EMH and share price will recover.

Hypotheses

Now that we have two critical elements in place: the need for a critical mass of female directors in order to have an impact on a male dominant and/or egocentric CEO; and expectation that in an efficient market, with a market announcement of female director appointment, the share price will dip initially, but recover in the long term (given all other metrics remain constant).

Therefore, this leads to our hypotheses:

- Hypothesis 1: Firms with overconfident CEOs, the higher the proportion of female directors in the total number of board members, the better the company's performance.

- Hypothesis 2: Company stock price tends to dip when an announcement of female director is appointed but expected to recover in the medium to long run.

Method Used

We have used three secondary research as basis of our analysis, and while we used the data from each research, we have added our own interpretations on the findings:

- To test if there is a positive correlation between firm performance and the presence of female directors on the board when the CEOs are overconfident, we examined using a US based comparable study “Mitigating Effects of Gender Diverse Boards in Companies Managed by Overconfident CEOs” by Banerjee, 2018. In this study the authors used S&P 1500 firms from the years 2012-2018. Tobin’s Q was used as our primary measure of long term firm value. The study also examined the impact of female directors and CEO overconfidence on firm-value by constructing a firm-year panel of all companies, except utilities and financial services, in the COMPUSTAT database that have the requisite data. Lastly we estimated these models with firm and year fixed effects. Standard errors are clustered by firm. Therefore, the model has followed specifications where firm performance is based on Tobin’s Q.

Source: Tobin’s Q formula used in Comparative Study

- To test the extent of female director presence, we examined using a Chinese A stock comparative study. The study chose performances of Chinese A stock companies between 2013 to 2017 and set 3 explanatory variables: female directors(Female), proportion of female directors (Feper) and square of proportion of female directors(Feper2). Least squares methods was used to conduct hypothesis testing.

- To test level of stock price volatility before an announcement of female director, we focused on a comparative study that tested stock movements before and after an announcement, this was achieved by using the Fama- French-Momentum Time-Series Model, Value Weighted Index, we found that in the five days prior to the announcement of the new director, there was a positive stock price reaction.

Findings

Hypothesis 1: Firms with overconfident CEOs, the higher the proportion of female directors in the total number of board members, the better the company's performance.

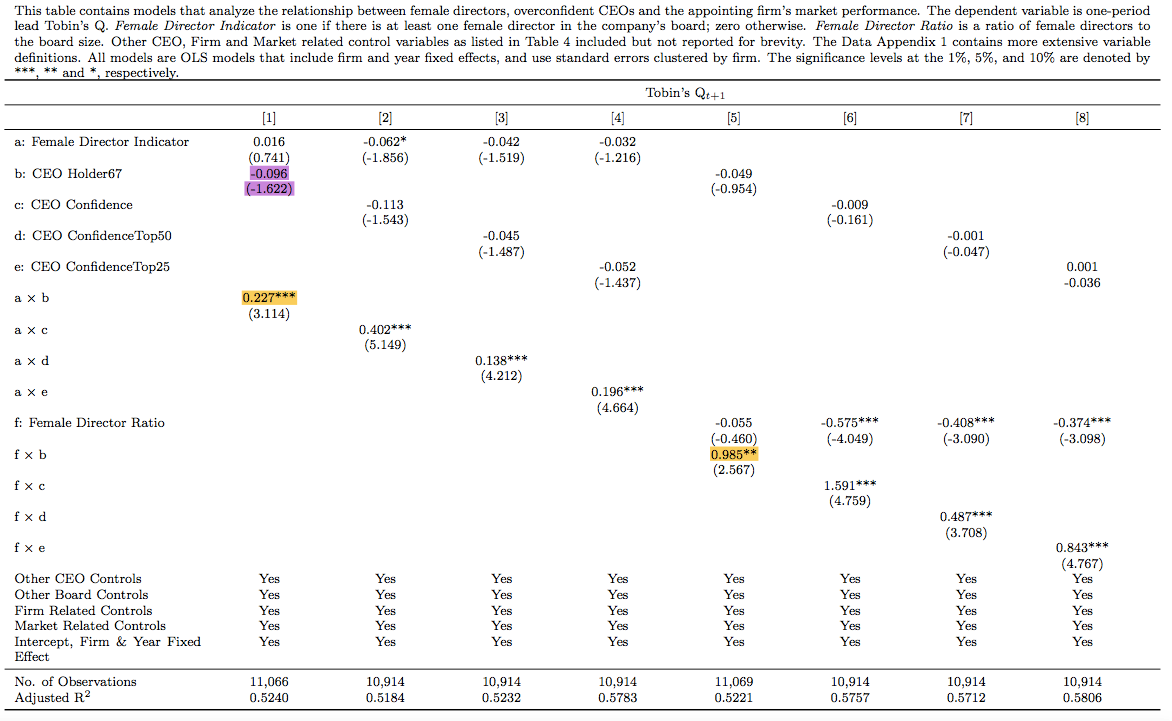

Since Tobin’s Q is the key measurement for company performance, data for Tobin’s Q can be found below in Table 1. As expected, the data showed a positive coefficient on the interaction term of an overconfident CEO and presence of female directors. Two main measures for female director presence: Female Director Indicator Columns (1 through 4) and Female Director Ratio as (Columns 5 to 8). As expected, results showed that overconfident CEOs have either no impact or negative impact in firms without a gender diverse board (no female directors), this is reflected in the insignificant (Columns 1 and 2) coefficients on CEO Holder67. But coefficients associated with the interaction term are positive and significant in all eight models. The coefficient associated with Female Director Indicator × CEO Holder67 is positive and significant at the 1% level in the first four columns. Similarly, the coefficients associated with the interaction term Female Director Ratio × CEO Holder67 are positive and significant in the last four columns. Such results indicate that the monitoring by female directors led boards resulted in mitigating risks presented by overconfident CEOs overconfident CEOs and increasing shareholder value. In extension, from the results as shown in Column 1, we can see that the net effect of overconfident CEOs on Tobin’s Q is 0.131 (0.227-0.096). Economically, the estimates from Column 5 indicate that one standard deviation (9.5%) increase (the addition of one female director) to a firm led by overconfident CEO adds 4.6% to a firm’s market value. From this, we can also derive the economic significance of our results: In Column 5, the coefficient on CEO Holder67 is -0.049 and the coefficient on the interaction term Female Director Ratio × CEO Holder67 is 0.985. Since the mean of Tobin’s Q in our sample is 1.935. Consequently, the overall effect of a 10% increase in the female director ratio for the average firm managed by overconfident CEO is equal to (0.985 − 0.049) × 0.095 = 0.0459 or 4.6% 1.935 increase in Tobin’s Q. Therefore, our first hypothesis stands true.

Table 1.

Source: Excerpt from Article “Mitigating Effects of Gender Diverse Boards in Companies Managed by Overconfident CEOs”, Banerjee, 2018

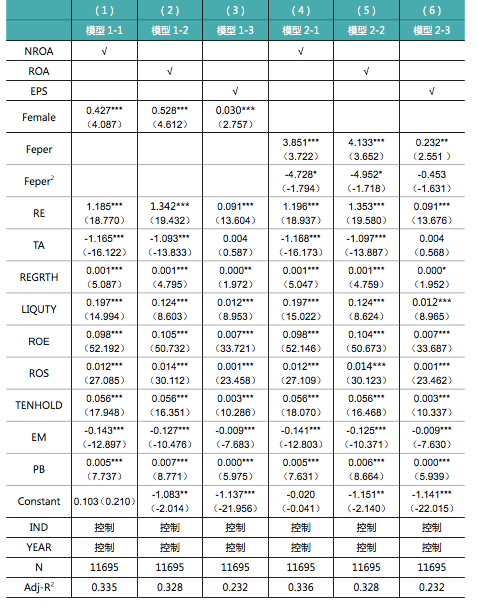

But now begs the question of what is the most “feasible” fraction of female directors in order to maximize corporate value? This has also been examined using a Chinese A stock comparative study. The study chose performances of Chinese A stock companies between 2013 to 2017 and set 3 explanatory variables: female directors(Female), proportion of female directors (Feper) and square of proportion of female directors(Feper2). Least squares methods was used to conduct hypothesis testing. As you can see from the below regression analysis in Table 2 (column 4), the total asset net return rate (NROA) is the explanatory variable, and the proportion of female directors and its square as the explanatory variable. The results show that the first-order coefficient of the proportion of female directors is positive, and Significant at the level of 1%; the quadratic coefficient of the proportion of female directors is negative and significant at the level of 10%. The results of the two indicate that there is a quadratic nonlinear inverted “U” relationship between the proportion of female directors and company performance, supporting our analysis to date. Since our H1 indicates that the higher the proportion of female directors in the total number of board members, the better the company's performance. When the highest point is reached, as the proportion of female directors increases, the company's performance will decline. Further calculation of the inflection point of this nonlinear relationship found that the optimal number of female directors in the total number of board members is about 40.73%. When the proportion of female directors on the board of listed companies is less than 40.73%, company performance will increase as the proportion of female directors increases When the proportion of female directors exceeds 40.73%, company performance will decline to a large extent as the proportion of female directors increases.

Table 2.

Source: Excerpt from “Do women in top management affect firm performance? “Smith.N, 2016

Hypothesis 2: Company stock price tends to dip when an announcement of female director is appointed but expected to recover in the medium to long run.

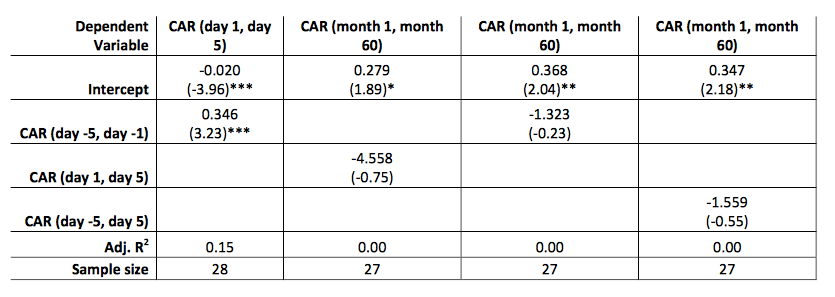

Using the Fama- French-Momentum Time-Series Model, Value Weighted Index, we found that in the five days prior to the announcement of the new director, there was a positive stock price reaction. This implies that investors were optimistic about the incoming new director. However, in the five days after the announcement of a female being appointed as the new director, there was a statistically significant negative reaction. In an efficient market, there could be a variety of reasons for this reaction, including the belief that females are more risk-averse and that the female may only be a “trophy director;” there solely to check off the company’s diversity box, this supports our analysis in the introduction.

A cross-sectional regressions comparing abnormal returns from different time periods related to the announcement of female appointment to the board of directors was also run to showcase this effect, as seen in Table 3. In comparing the cumulative abnormal returns from five days to one day prior (-5, -1) to the date of announcement with the cumulative abnormal return from one day to five days after (1, 5) the date of announcement, we found a statistically significant positive relationship. In comparing the long-term cumulative abnormal returns to announcement period returns (day -5, day -15), the relationship found was not statistically significant, meaning that the long-term returns are not related to announcement period returns. This holds true after it is revealed that the newly elected director is female, as shown through the regression between (month 1, month 60) and (day +1, day +5) having no statistical significance. These results show that neither is the market inefficient nor is the announcement period reaction suggesting a negative reaction to female appointment.

Table 3.

Source: Excerpt from “First Female Directors: A Market Response”, Fredrick’s, 2014

Explanation of the findings

The findings itself may not be surprising, however it’s worth diving into the root causes to why the current business world still fails to recognize the important role women plays in the board room and why investors penalize companies for nominating female directors. What’s interesting is why there is a dip in the share price (negative market reaction) if a female director is nominated. It is well documented in finance research that women are more risk-averse than men. This may be beneficial during an economic downturn (bear market), helping to limit losses during these times. However, given that recessions are short-lived relative to expansions, the overall effect of women being risk- averse would be negative, hence risk averse perception can be a double edge sword – female directors’ risk-aversion may prevent them from fully maximizing the benefits presented by an economic upswing. Consequently this will be reflected as a negative market reaction to the announcement of the female being elected.

In addition, female representation on corporate boards often constitutes an play of optics - a diversity measure or is perceived as such (Farrell and Hersch 2005, Broome et al. 2011). If investors believe that female board members have been appointed to satisfy a preference for diversity, then by increasing board diversity, a firm unintentionally signals a weaker commitment to shareholder value than a firm with a non-diverse board. Because investors, most of whom seek short-term returns (Bolton and Samama 2013), look for signals that firms prioritize shareholder value, and because a diversity preference may not send such a signal, firms that increase board diversity will be penalized and suffer a decrease in market value. Again, this notion may be beneficial during a bull market or economic downturn, helping to limit losses during these times. But, given that recessions are short-lived relative to expansions, the overall effect of women being risk- averse would again be negative.

However, in the long run, the share price is expected to recover as per the efficient market theory (the market will adjust itself accordingly). This positive reaction may occur if the company and its investors value diversity of opinion, since having diverse opinions provide more diverse angles for evaluating problems and decisions, resulting in a decrease in likely herd behavior. Given the social structure of traditional boards, when a woman is selected to join the board, she is very likely to be of an exceptional quality and have outstanding capabilities. The so called exceptional qualities that the selected female provides to the board will increase the insights and level of oversight provided by the board as female board directors are seen as positive and mitigation to overconfident CEO’s risks. This is something that should encourages a positive response in investors and helps to cause a positive stock price reaction to the announcement.

Arbitrage Strategy:

Based on the confirmation of our two hypotheses we are proposing for the following two layered strategies:

- Locate companies with ‘overconfident’ CEOs (egocentric, media exposure) and significant female presence on the board (close to 40%);

- Best time to buy is immediately after an announcement of female director appointment

Whether across US and/or Chinese A Stocks, it is important to identify stocks with a significant number of female directors on the board (2/5 is the best ratio), this is particularly more effective if the market is in a bear market or challenging times, showcasing that female presence could be highlighted, in addition it’s useful to test if the CEO is ‘overconfident’ or attention seeking, this usually means that the CEO places his/her ego first. In light of targeting such stocks, it is also worthwhile to take notice of the potential timing of buying, particularly if an appointment announcement is imminent, as the announcement would usually be followed by a dip in the share price, it would make sense to purchase at a cheaper price.

Conclusion

The role of women in the corporate world is essential, their contribution to shareholder value generation are underappreciated and overlooked, whether this is result of social or cultural phenomena, it is critical to understand and advocate on behalf of equality for women in the workplace. This paper aims to achieve more than a case of justifying women’s role from a business value perspective; it is also a socially important task. From our study, comparing across the US and China markets, the overall major findings of this study suggest that the presence of female directors, and especially female independent directors, improves corporate governance standards and helps to mitigate the potentially harmful aspects of CEO overconfidence, but importantly it does not appear to undercut the positive aspects of having overconfident CEOs. We believe that the diverse perspectives of directors of different genders enable boards to become better monitors and advisors, which in turn, has a positive impact on the governance of public corporations and on firm performance and valuation.

References

1. Ball, R. 1994. The theory of stock market efficiency: Accomplishments and limitations. In J. Stern and D. Chew Jr. (ed.) The Revolution in Corporate Finance. Malden: Blackwell Publishing.

2. Catalyst. 2004. The Bottom Line: Connecting corporate performance and gender diversity.

Doepke, M. and Tertilt, M. 2014. Does female empowerment promote economic development?.

3. Efficient Market Hypothesis definition (n.d.). Retrieved 11 March, 2014, from http://www.investopedia.com/terms/e/efficientmarkethypothesis.asp.

4. Fogel, K., Ma, L., and Morck, R. 2014. Powerful Independent Directors.

5. Francis, B., Iftekhar, H., Park, J., and Wu, Q. 2014. Gender differences in financial reporting decision-making: Evidence from accounting conservatism.

6. Larcker, D. and Tayan, B. 2013. Pioneering women on boards: Pathways of the first female directors.

7. Loukil, N. and Yousfi, O. Does gender diversity on board lead to risk-taking? Empirical evidence from Tunisia.

8. Raheja, C. G., 2005. Determinants of board size and composition: A theory of corporate boards. Journal of financial and quantitative analysis 40 (02), 283–306.

9. Roll, R., 1986. The hubris hypothesis of corporate takeovers. The Journal of Business 59 (2), 197–216.

10. Shu, P.-G., Yeh, Y.-H., Chiang, T.-L., Hung, J.-Y., 2013. Managerial overconfidence and share repurchases. International Review of Finance 13 (1), 39–65.

11. Simsek, Z., Heavy, C., Veiga, J., 2010. The impact of CEO core self-evaluation on the firm’s en- trepreneurial orientation. Strategic Management Journal 31 (1), 110–19.